85 cents per kilometre for 2023-24; 78 cents per kilometre for 2022-23; 72 cents per kilometre for 2020-21 and 2021-22; 68 cents per kilometre for 2018-19 and 2019-20; 66 cents per kilometre for 2017-18. How you use this method. To work out how much you can claim, multiply the total business kilometres you travelled by the rate.. The cents per kilometre method uses a set rate for each work-related kilometre travelled up to a maximum of 5,000 kilometres per car, per year. For the 2022-23 income year the rate per kilometre has increased from 72c to 78c. Limitations. You can’t use this calculator to calculate any expenses relating to: motorcycles; vehicles with a.

January 2022 Freight Rate & Trucking YouTube

INFOGRAPHIC Trucking Rates per mile by regions Sept 2020 SONAR

2022 review of road freight transport in Europe

trucking rates per mile 2021 uk Stabilising Cyberzine Photographic Exhibit

Trucking Cost Per Mile Spreadsheet —

What Are The Trucking Rates Per Mile in 2022?

See How Rising Truck Rates Help Spur Price Hikes for LBM Products ProSales Online Lumber

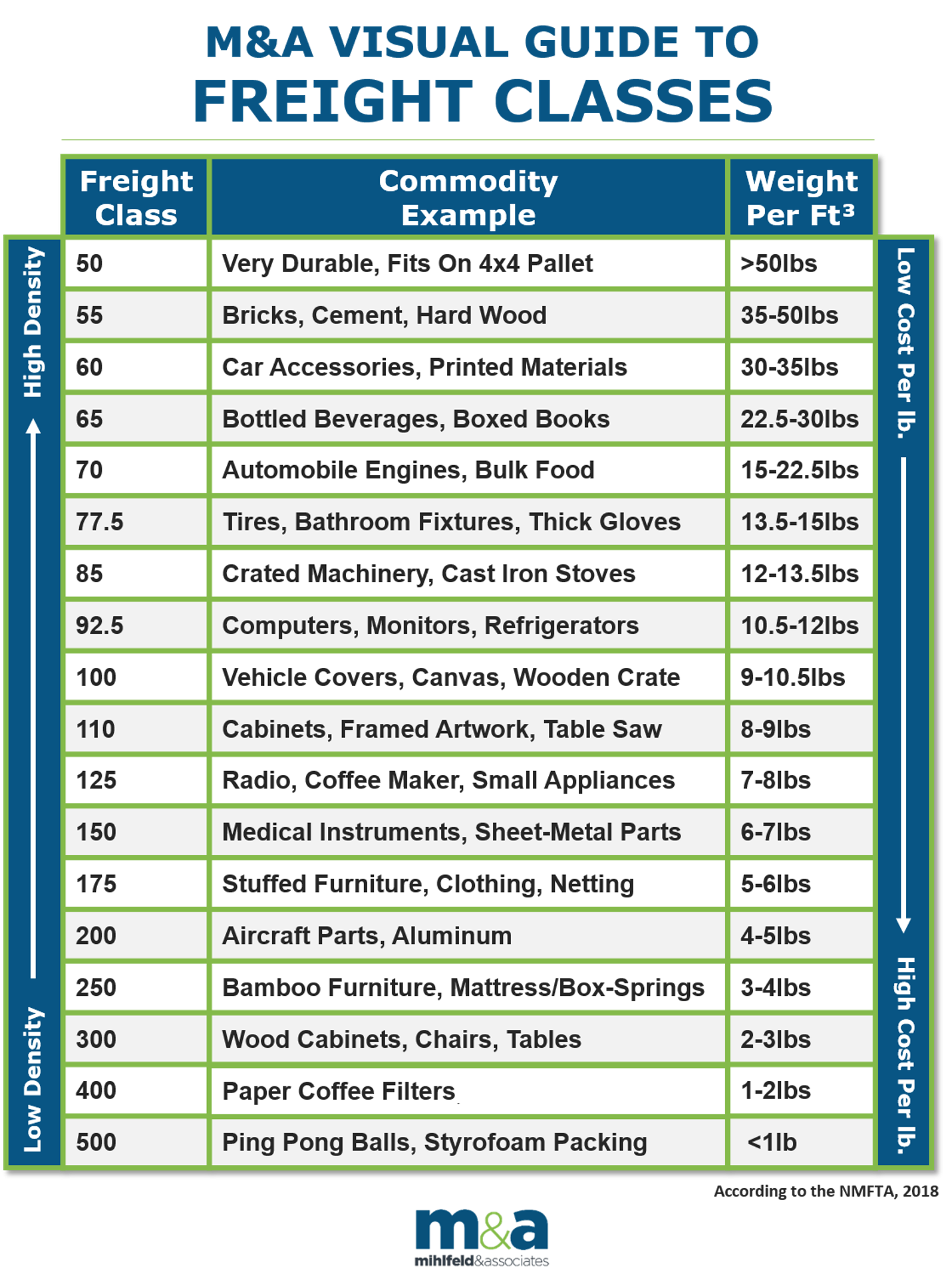

A Quick Guide to Freight Classifications and How to Use Them

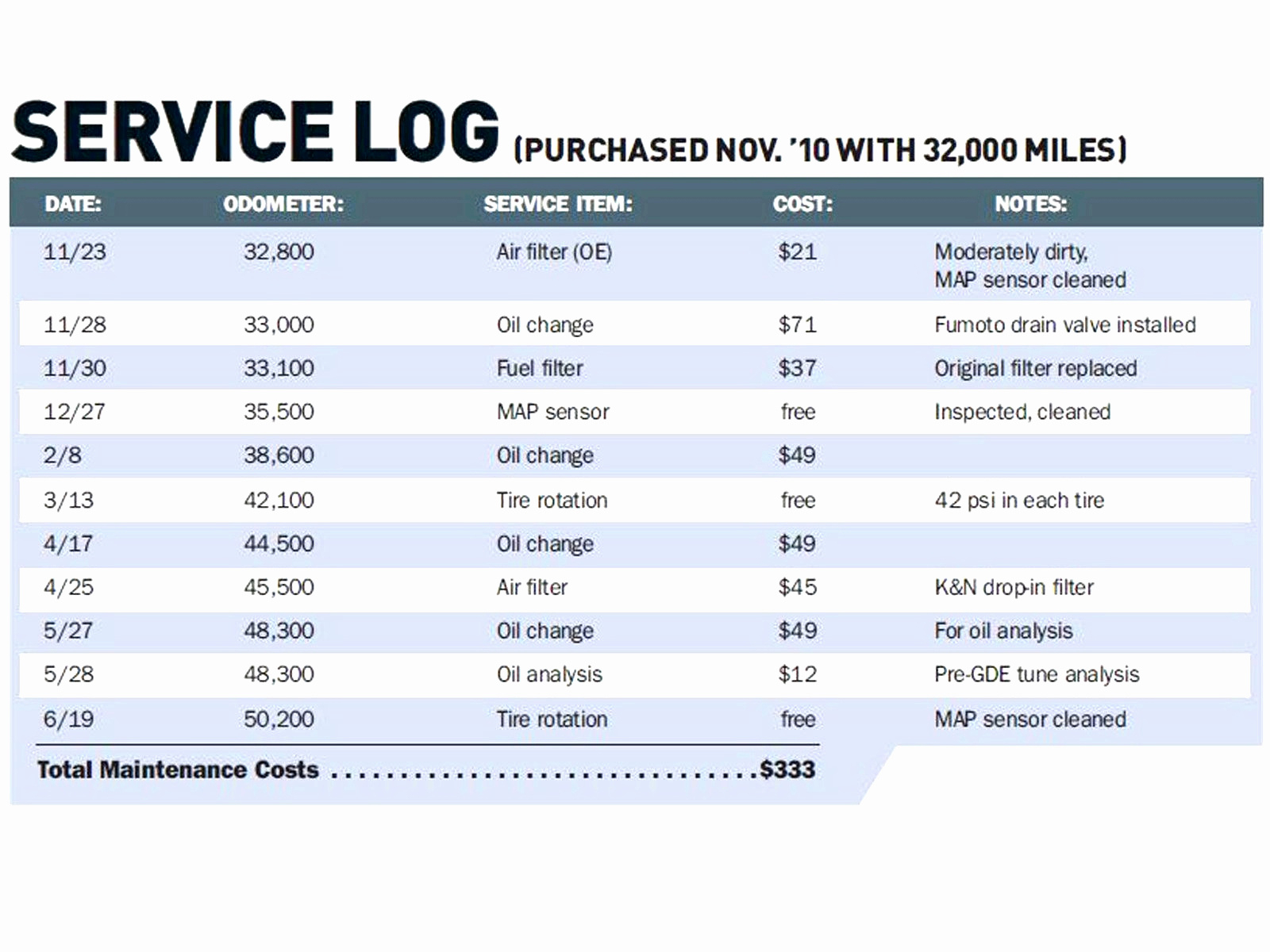

Trucking Cost Per Mile Calculator How to Determine Your Total Cost of Ownership Fleetio

9+ Dump Truck Hauling Rates Per Ton AslamAshrith

Cost Per Kilometer by Industry Download Scientific Diagram

The Cost of Trucking IMI

Supply Chain Graphic of the Week Components of US Trucking Costs

The Prescribed Travel Rate per KM increases and the Determined Travel Allowance Rate Table is

Truck driver hiring slows as permile rates surge

Improved truckload demand drives increase in freight rates

Trucking rates per mile in 2022 Cardinal Logistic Services

Hotshot Trucking Rates Per Mile 2021 How To Manage And Maximize Revenue

trucking rates per mile 2021 uk Stabilising Cyberzine Photographic Exhibit

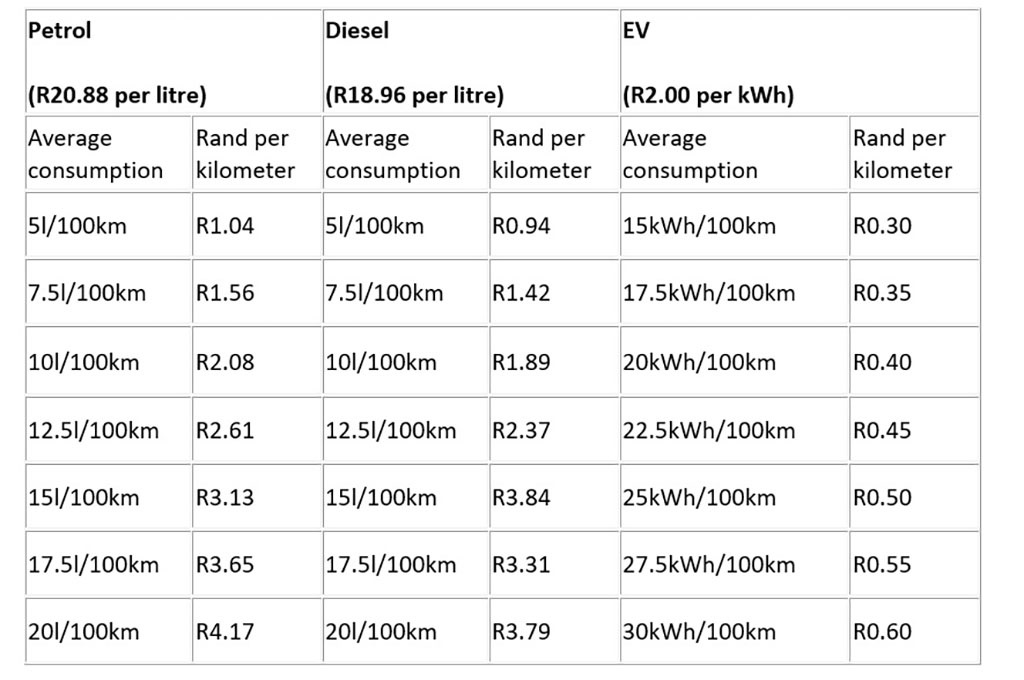

A cost per km comparison Insane fuel prices are EVs really cheaper than ICE cars? Wheels

A National Transport Commission (NTC) study in 2008 found a link between low rates of pay and poor safety in the trucking industry. A regulatory impact statement released prior to the establishment of the RSRT found that 29 per cent of Australia’s 71,000 owner-drivers were working for less than the minimum wage.. Step 5: Finance (per vehicle) Loan repayments are calculated based on constant payments and a constant interest rate (averaged). Balloon is the residual lump sum payment payable at the end of the loan (if selected to be used). Depreciation rates and limits are set by the Tax Office.