The insurance industry’s data is growing at a rapid pace, with a 90 percent growth in the last two years. Data analysis is used by insurance companies to better determine the price of policies, settle claims, study consumer behavior to facilitate benefit distributions, detect fraud, and map dangers, among other things.. 2024 data analytics trends for insurance. Advancements in data analytics have led to rapid transformations in the insurance industry. Top trends include focusing on opportunities with predictive analytics, which allow for a deeper understanding of individual client preferences, life circumstances, potential risks, and buying behaviors.

New Insurance Industry Analytics Podcast

How Big Data is Transforming Insurtech Sector Jelvix

Who are The Best Electronic Insurance Companies for 2023 ElectricXpert

Klipfolio for Insurance Companies

13 Top Insurance Industry Trends 2021/2022 Data, Statistics & Predictions

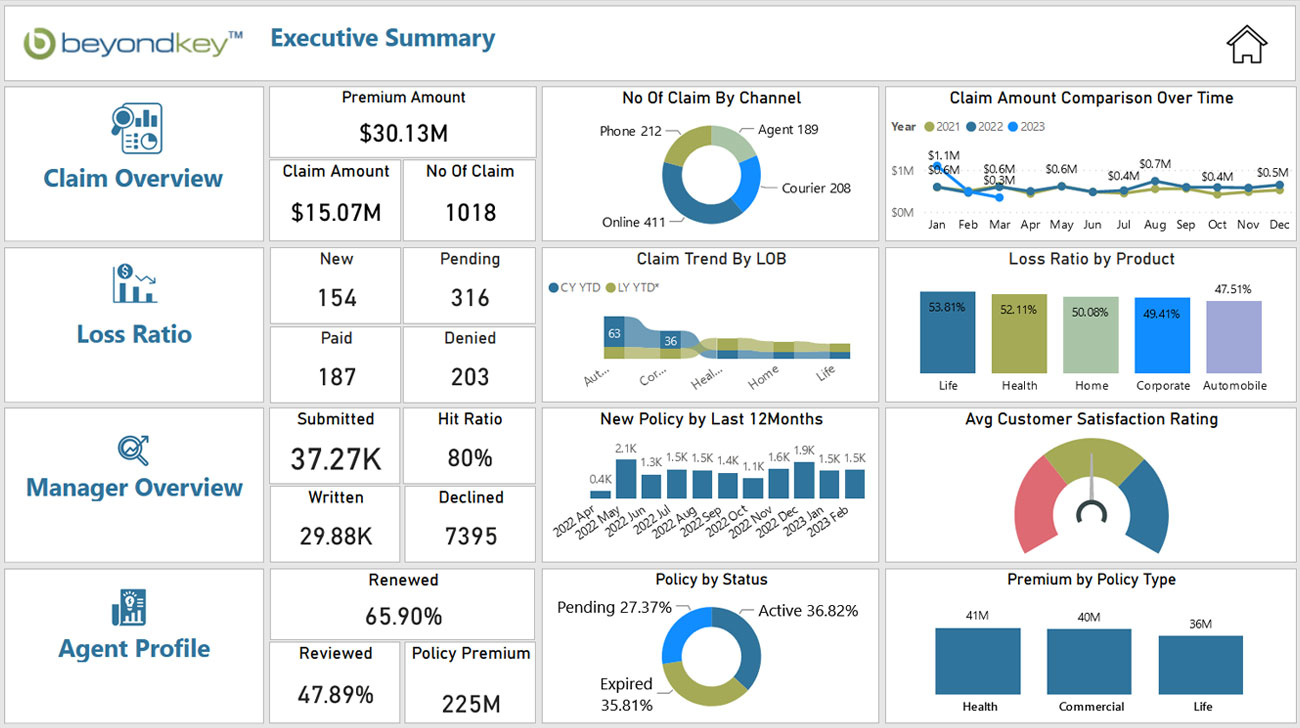

Insurance analytics Insurance dashboard Beyond Key

Revolutionizing the Insurance Industry with Data Analytics and AI

“Insurance Industry Trends What’s New and What’s Next”

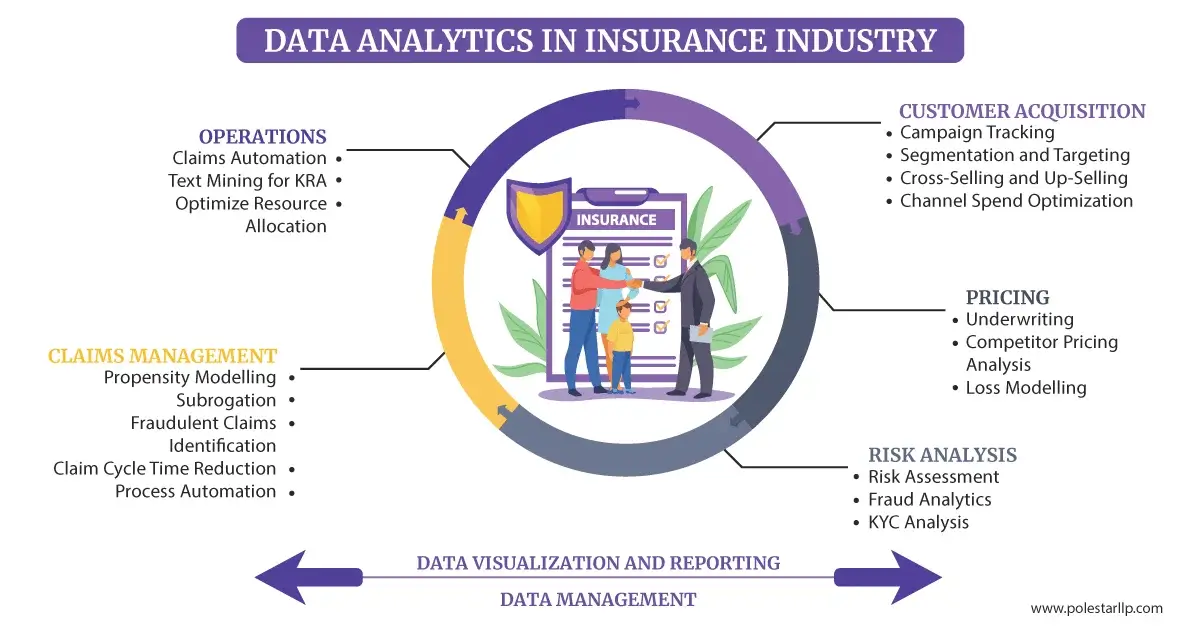

Data Analytics in the Insurance Industry

Kpis Of Insurance Companies ABINSURA

Data Analytics in Insurance Industry The Ultimate Guide

9Step Model for Data Analysis Insurance Thought Leadership

Health insurance sector in India an analysis of its performance Emerald Insight

60 Insurance Statistics You Must Read 2024 Market Share Analysis & Data

Health insurance sector in India an analysis of its performance Emerald Insight

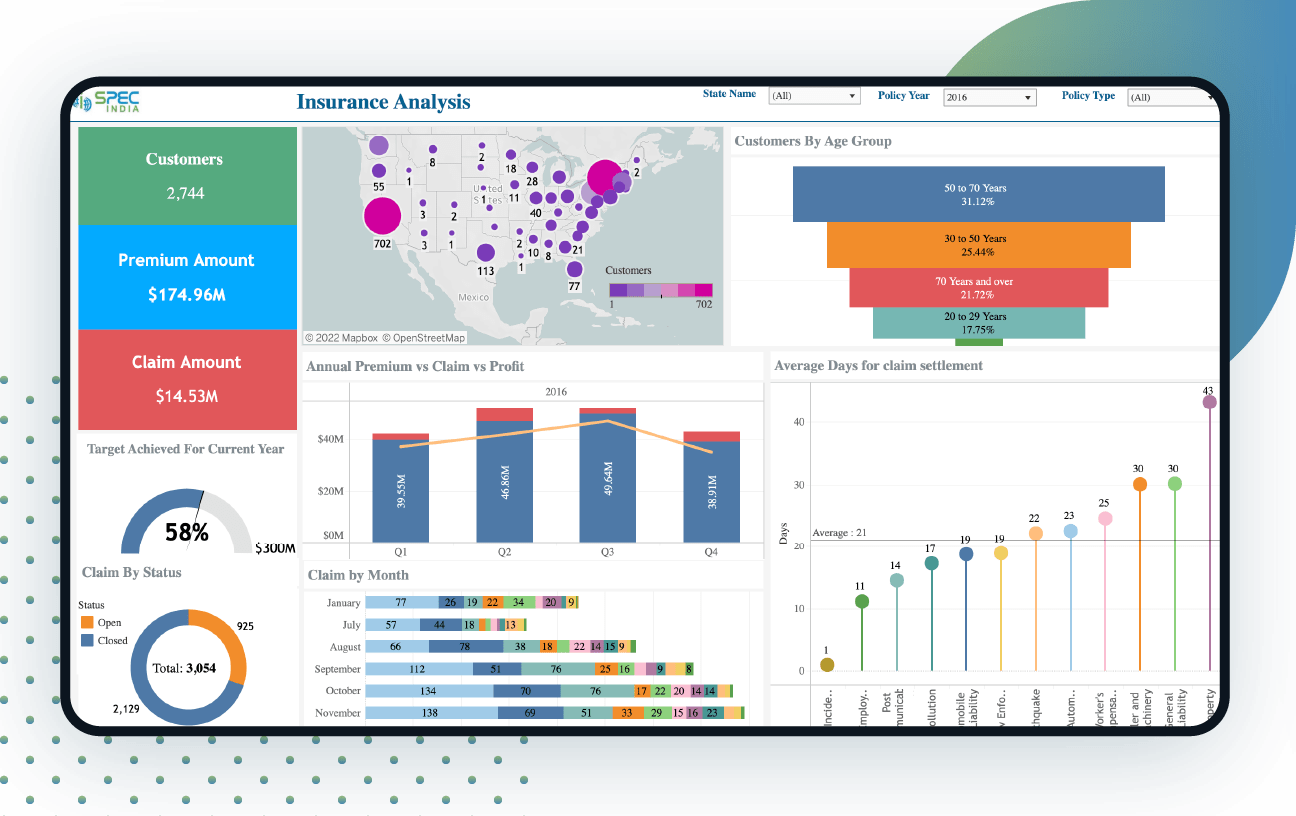

Healthcare Insurance Analysis Dashboard SPEC INDIA

Statistical Data Analysis insurance what kind and at what cost

Ivy Professional School Official Blog Data Science In Insurance Industry & Its Importance

What is Insurance Data Analytics? Big Data Uses in Insurance WaterStreet Company

Predictive Analytics in Insurance Company Insurance BI

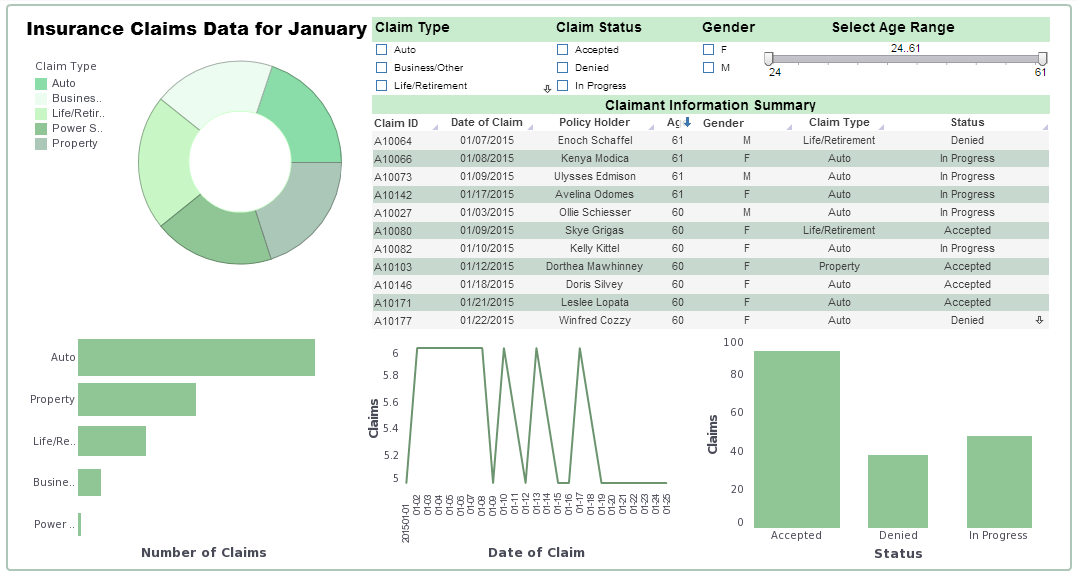

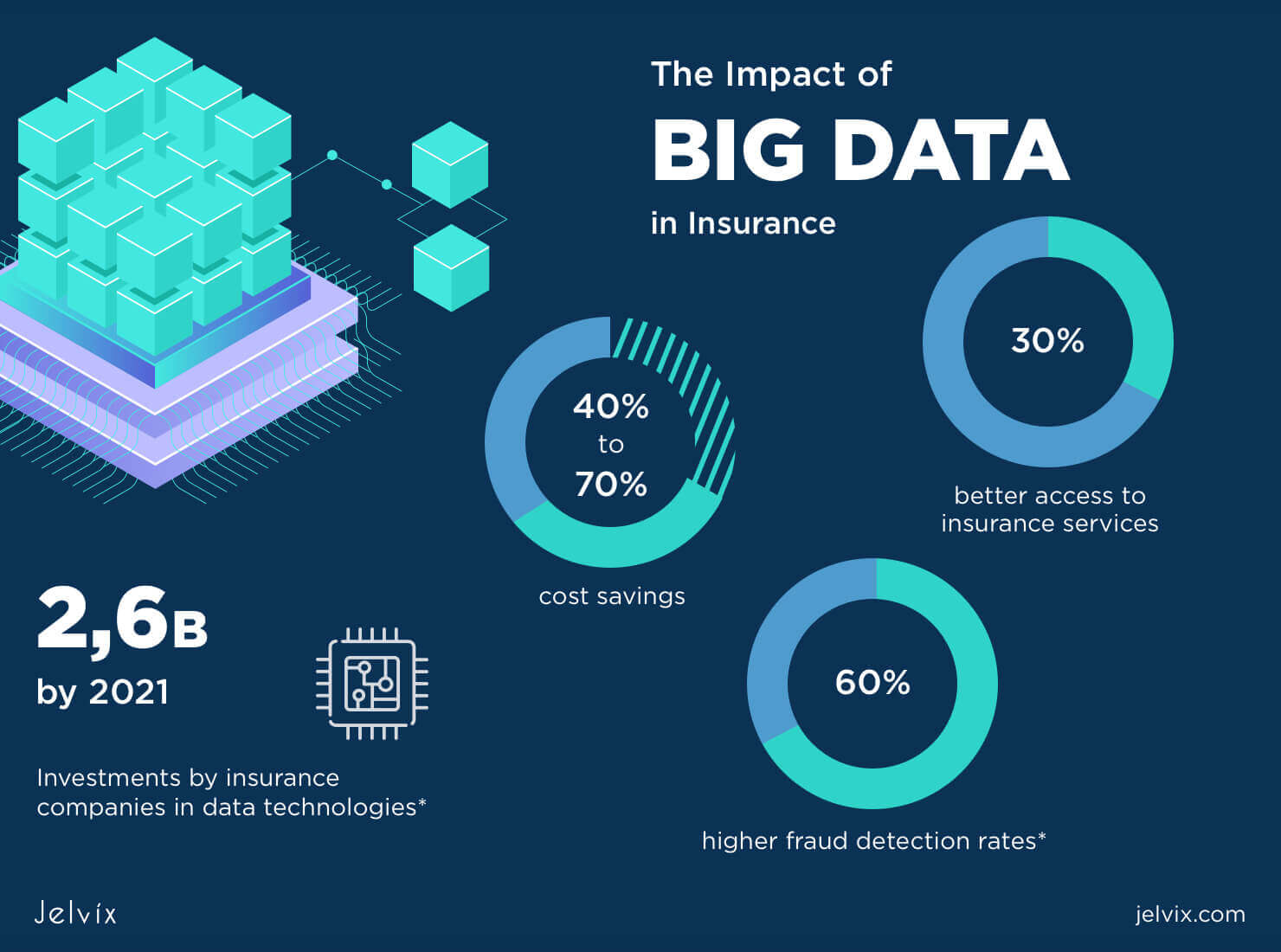

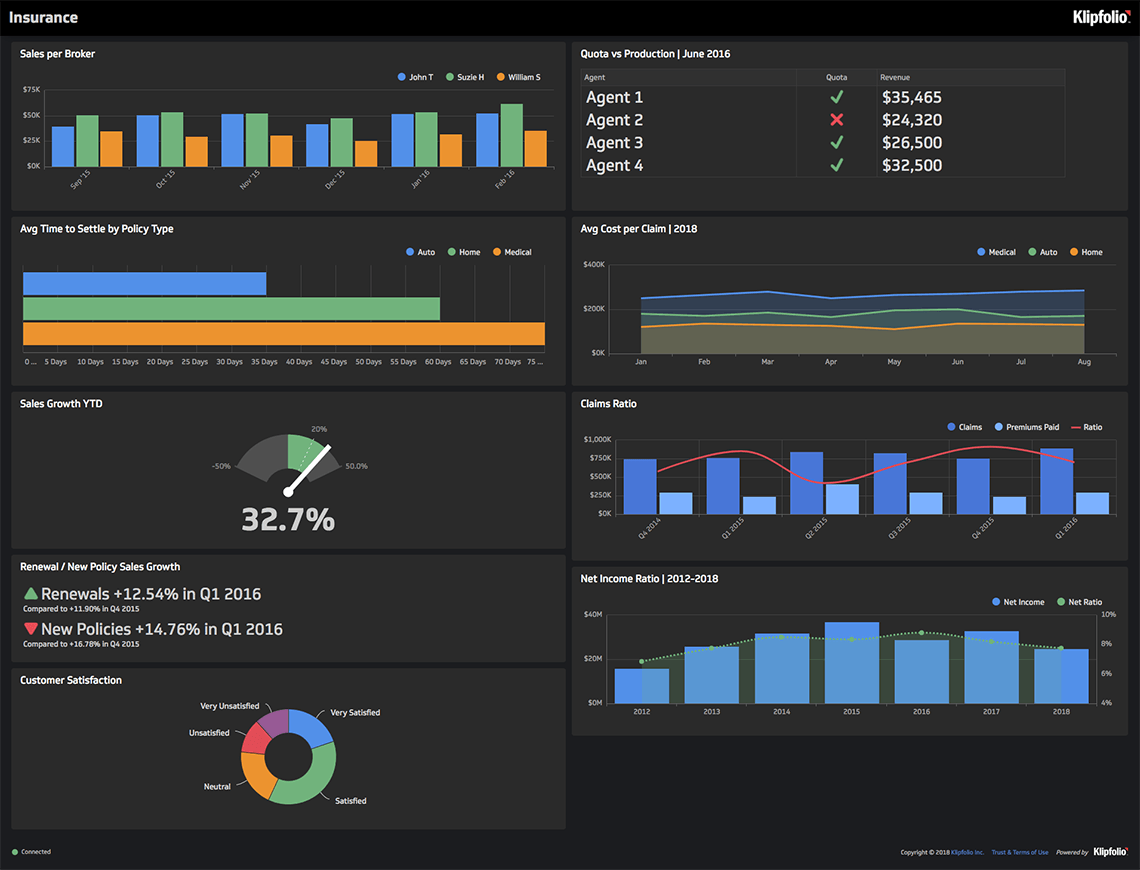

Data analytics offers a solution to the critical challenges of customer retention and loyalty fostering in the insurance industry. Insurers can tailor their services and communication to individual needs by understanding customer behavior and preferences through data analysis.. The use of big insurance data analytics in the insurance industry is rising. Insurance companies invested $3.6 billion in 2021. Companies that invested in big data analytics have seen 30%more efficiency, 40% to 70% cost savings, and a 60%increase in fraud detection rates. Both the customers and companies benefit from these solutions, allowing.