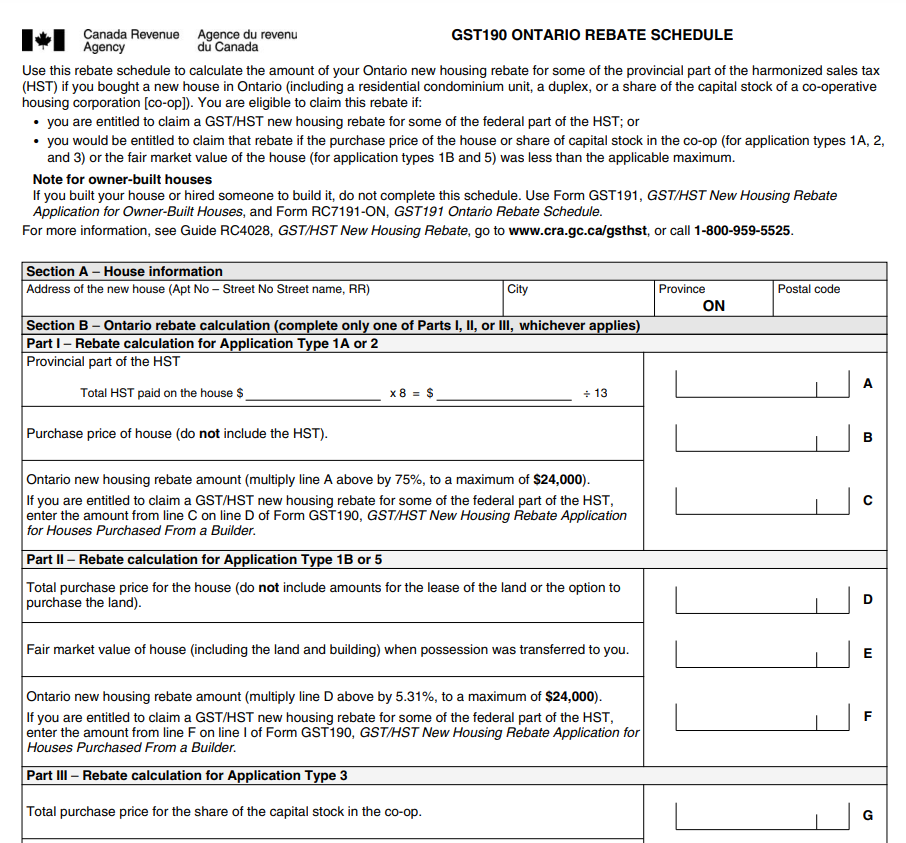

The provincial rebate amount caps and is applicable on the first $400,000. So the maximum new housing rebate amount available in Ontario is 6% of $400,000, which amounts to $24,000. While the purchase price of homes should be less than $450,000 in order to qualify for the Federal rebate, for homes valued above $450,000, homebuyers may still.. Ontario new housing rebate amount (multiply line D above by 5.31%, to a maximum of $24,000). If you are entitled to claim a GST/HST new housing rebate for some of the federal part of the HST, enter the amount from line F on line I of Form GST190, GST/HST New Housing Rebate Application for Houses Purchased From a Builder.

Fillable Online New Housing GST/HST Rebate Application Form GST 190 Fax Email Print pdfFiller

GST/HST New Housing Rebate and New Residential Rental Property Rebate SQI CPA Professional

How to Calculate the GST / HST New Housing Rebate Sproule+Associates

Hst New Housing Rebate Sukhi Atwal

Ontario New Housing Rebate Form

Tax Rebate Blog Series GST/HST New Housing Rebate

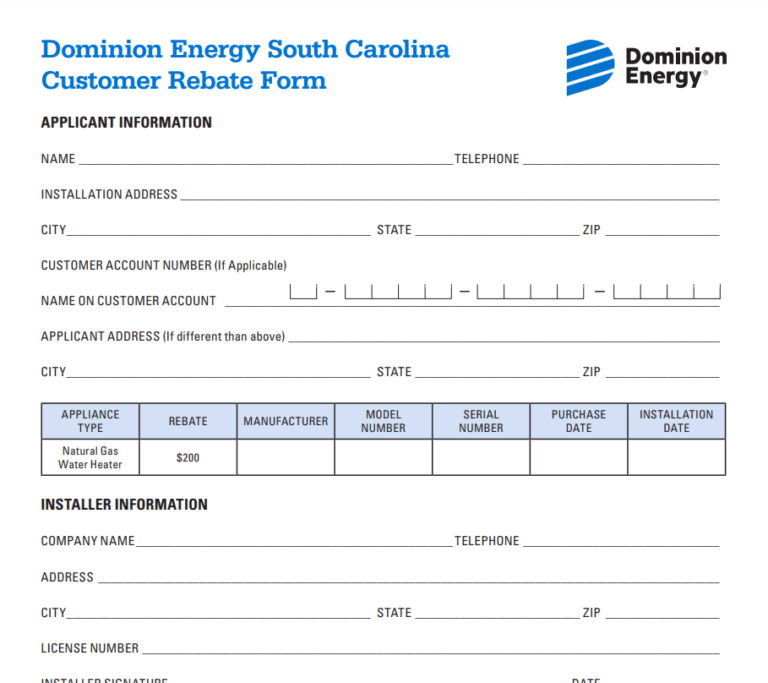

Dominion Rebate For New Furnace Printable Rebate Form

HST New Housing Rebate Canadian Property Expert

How Long Does It Take to Get HST Housing Rebate?

Mobil Delvac 15w40 Rebate Printable Rebate Form

GST/HST New Housing Rebate in Ontario GTAHomes

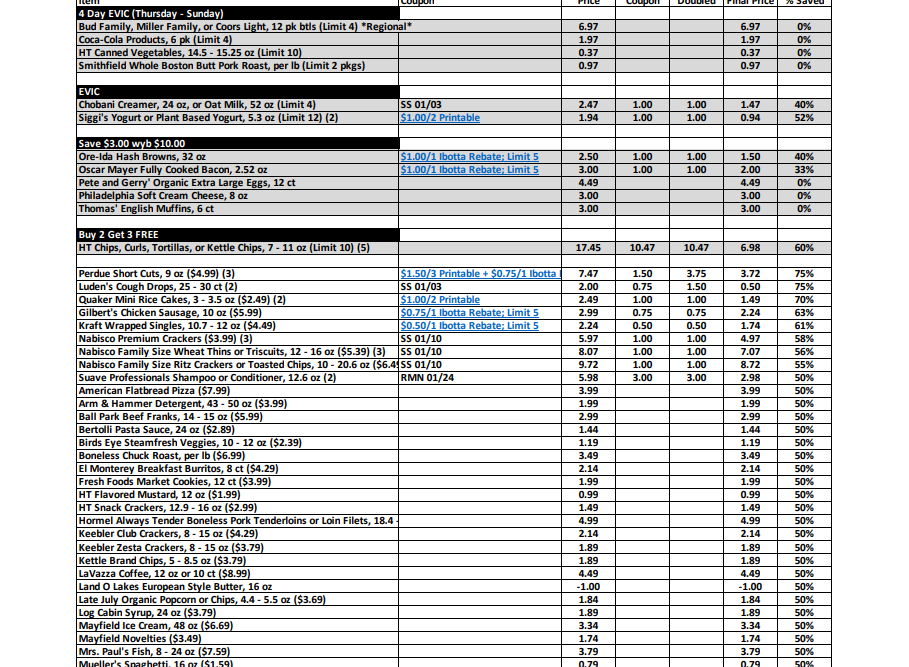

Harris Teeter Rebate Printable Rebate Form

Bridgestone Rebate Form 2023 Printable Rebate Form

June tax news Buying property from a nonresident, HST rulesand more KRP

Form For Renters Rebate

How do I claim GST/HST housing rebate? RKB Accounting & Tax Services

Speed Queen Rebate Form 2023 Printable Rebate Form

HST Rebate Forms Ontario

Housing Rebate Form 2023 Printable Rebate Form

How to Qualify for GST/HST NEW HOUSING REBATE on RENOVATED and OWNER BUILT HOMES REAL ESTATE

How to apply for the Ontario new housing rebate. The purchaser would apply for the Ontario new housing rebate by completing a provincial rebate schedule, RC7190-ON, GST190 Ontario Rebate Schedule that will form part of the GST/HST new housing rebate application, Form GST190, GST/HST New Housing Rebate Application for Houses Purchased from a.. GST/HST new housing rebate amount (enter the amount from line 4 of Form RC7190-WS). C D Provincial new housing rebate amount – If you are eligible, complete the calculation on the applicable provincial rebate schedule and enter the amount from line C of that schedule. Total rebate amount including any provincial rebate (line C plus line D). E